Hello everyone! It’s been a minute and I hope you’ve all been enjoying life recently. If you are new here or haven’t been following very closely, click the link below to go to my home page. Be sure to take a look at my first two newsletters, which cover some of the basics around credit card points.

This week’s newsletter will cover a recommendation for everyone’s favorite points starter card, the Chase Sapphire Preferred. If you are familiar with Chase Sapphire cards and Ultimate Rewards points, it’s still worth skimming my review as you may learn something new. Next newsletter, I’ll give a real world example and trip report of how I used Chase Ultimate Rewards points for a weekend getaway to San Diego.

Everyone’s Favorite Starter Card, the Chase Sapphire Preferred

Let’s talk about Chase. The name for Chase’s credit card points is called (as I’m sure you guessed) Ultimate Rewards. I’ll just call them UR, or points, from now on. There are several Chase credit cards that earn points, but only three cards that can utilize transfer partners and give you a points “boost” on the Chase travel portal. The Chase Sapphire Preferred (or the CSP) is one of those cards and in my opinion, has the most mass appeal.

***Quick disclaimer about opening credit cards! If you cannot organically meet the spend for the sign up bonus, meaning you will be spending above your means just to get these points, DO NOT open a new credit card! The last thing you want to do is go into debt because you want points. These cards will always be around, wait until it makes more sense for you before signing up.***

Card Basics

Sign Up Bonus

80,000 points after $4,000 in spend in the first three months. Offer available online (and through my referral link posted at the end of this newsletter (I promised I wouldn’t shill, but does it count when I’m shilling for myself?))

OR

90,000 points (80k after $4,000 in spend in first three months + 10k after $6,000 total spend in first six months). Offer only available by applying physically in a Chase Branch

Earning Structure

3 points per $ spent at restaurants, online grocery shopping, and some streaming services

2 points per $ spent on all travel purchases

5 points per $ spent on travel purchased through the Chase Travel Portal

5 points per $ spent on Lyft

1 point per $ spent on everything else

Annual Fee

$95

Annual Credits

$50 statement credit on hotel stays booked through the Chase Travel Portal

How much are UR Points worth?

I personally value Chase’s UR points between 1.25 cents/point and 1.8 cents/point

Quick recap of “cents per point”

This is a way to compare your imaginary, credit card / loyalty points to something more tangible, like US Dollars. Since points aren’t all created equally, it’s good to have a standardized way to compare them, hence we look at how many cents ($0.01) each point is worth, aka cents/point.

1,000 Hilton Honors points are not worth the same as 1,000 Chase UR points. When we compare their value against something like USD, it becomes apparent. Hilton points are generally considered to be worth about 0.6 ($0.006) cents/point based on how much money you save when using points at Hilton Hotels instead of paying cash.

In my experience, Chase UR are worth between 1.25 and 1.8 ($0.0125 - $0.018) cents/point, meaning 1 Chase point can save me up to 3x more cash than 1 Hilton point would when paying for travel with points.

Why Is The CSP a Great Starter Card?

First, let’s look at the most important aspect of this card: it accumulates transferrable points. It also does this with a relatively low annual fee of only $95. The bigger brother to the CSP, the Chase Sapphire Reserve, has an annual fee of $550 for comparison. This isn’t really a fair comparison because that card has wildly different perks, but it does put some things into perspective.

Second, your points have a bare minimum value of 1.25 cents/point when used on Chase’s own travel portal. Their travel portal is basically a rebranded version of Expedia meaning you can book flights, hotels, car rentals, etc.

To make things simple think of it like this: 10,000 points can be redeemed for $125 towards travel on their portal. You don’t need to worry about transfer partners or calculating “Is this a good use of my points?” It will always be the same fixed value of 1.25 cents/point no matter what you are booking.

Below you will find a screenshot of the desktop version of the what the travel portal looks like just because I am a visual learner and I think it helps to be able to picture what I’m talking about. You can see it even tells me my 87,000 points are worth just over $1,088 towards travel purchases on the portal.

This means that the sign up bonus on the card is going to be worth between $1,000 and $1,125 (depending on how you apply) if you use the points exclusively through the travel portal. That $95 annual fee doesn’t look so bad now, does it?

This is a great option if you are the type of person who doesn’t want to bother with learning about transfer partners (see my Second Edition newsletter for an example of using transfer partners in action to get more value). There is nothing wrong with only using the portal, and I have done this dozens of times. It’s saved me hundreds of dollars in travel and that is the point of all of this, right?

Can you get better value out of your points by transferring them to a different loyalty program? Yes, absolutely. Is the juice worth the squeeze? Only you can decide what your time is worth and if using the portal is the best option for you. There are always some things to be considerate of when using a third-party booking website, like the travel portal. Cancellation policies vary and if you need to make changes, you will likely need to contact Chase instead of the airline or hotel you booked.

If you are saying “Hey! The reason I subscribed to this newsletter is so I can get those crazy flights to Europe for only 20,000 points each way. I want to learn how to play the game!” well, this card is also for you. The reason is because of those transfer partners.

Transfer Partners

Chase has 15 different transfer partners, most of which can help you get to wherever you want to go in the world if you know what you’re looking for. I have personally used 8 of them for flights and hotels at places like Portland Oregon, Vancouver, Palm Desert, Amsterdam, and Prague just to name a few. By transferring to these programs, I got a better value than the fixed 1.25 cents/point offered through the travel portal, saving me points and in turn, more money.

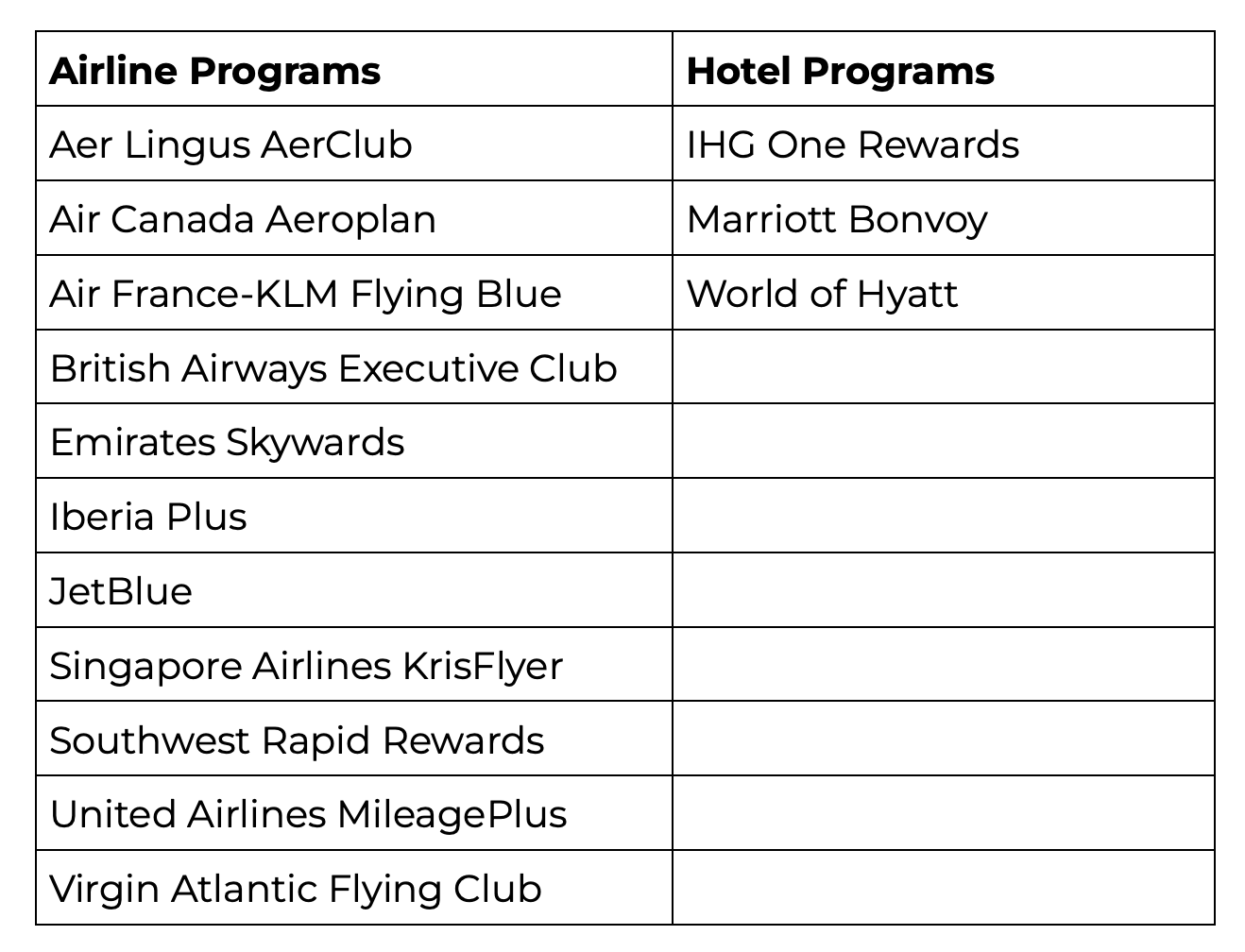

Here is a table listing all of Chase’s airline and hotel transfer partners. All of these transfer at a 1:1 ratio and most transfers happen instantly. If you don’t recognize most of these, don’t worry, I didn’t either and you might not ever need to know depending on where you want to travel.

Chase has a good mix of international and domestic flight airlines. For domestic, you can transfer points directly to JetBlue, Southwest, and United. By comparison, American Express only has JetBlue (which transfers at a worse 2.5:2 ratio instead of Chase’s 1:1) and Delta Airlines as domestic transfer partners. Capital One doesn’t have any domestic airline partners!

Chase being the only transfer partner for United and Southwest can be huge if they have a large presence where you live. Since I live in the Bay Area, this works really well for me since something like 60% of the flights out of SFO are United, and at least 50% of flights out of Oakland are Southwest.

All of Chase’s international partners can help get you fly internationally and even book flights through other domestic airlines not listed in this table. I will talk more about this in the future, but did you know you can actually book Delta tickets using Air France-KLM Flying Blue points, or Alaska Airlines tickets using British Airways points?

The biggest draw for me though is being able to transfer points to Hyatt Hotel’s program, World of Hyatt. I have an affinity for Hyatt hotels, mostly because of Kayla and her family (shoutout Stef), but generally, their points program is the most valuable when it comes to hotel stays. Chase is the only major program that transfer points to Hyatt! (Technically a newcomer card called Bilt Rewards does too, but they are much more niche).

I’ll give a great example of value of Hyatt points in my next newsletter when I go over my San Diego trip redemption, but typically you can expect to get about 1.7 cents/point with Hyatt’s program. So 10,000 Hyatt points will get you roughly $170 towards Hyatt hotel stays without putting in much effort.

Ancillary Benefits

This card also has some other benefits that may be useful to some of you. Click here for a link to the official Chase PDF for all of the benefits. I’ve bulleted out a very brief version of the benefits I have personally used or read about from real people not selling you anything. Please note a lot of these benefits are not unique to this card. Many other credit cards with an annual fee also offer the same or similar benefits, but it is an added bonus to have, especially if you only want one catch-all credit card.

$50 hotel statement credit to use annually when booking any hotel through the Chase travel portal

No foreign transaction fees

Free DoorDash Dash Pass

Primary Auto rental collision damage waiver when renting a car (so you can decline the rental company’s expensive insurance policy)

Purchase protection which covers items you purchased on the card for up to 120 days in case of damage, theft, or “involuntary and accidental parting” up to $500 per item

Extended warranty protection which adds one additional year to the manufacturer’s warranty (if the original warranty is three years or less), up to $10,000 per claim

I used this benefit on a MacBook Pro where the Touchbar broke after just over a year. Apple said it is no longer covered by their warranty and gave me a quote for a repair order saying it would cost $580 to fix

I filed a claim with Chase, uploaded the repair quote and the purchase receipt showing I still should have about seven months of extended warranty left. After about 48 hours I had a direct deposit into my checking account for $580 from Chase

There are also TONS of travel related insurance benefits, which I have personally never used but have read is extremely hard to actually use. The insurance company that Chase partners with will find any excuse to deny your claim (like most insurance companies), and there are lots of rules as to what “qualifies” under the benefits.

Remember when I said this newsletter will be no B.S. and shilling? Well unlike many other blogs who tout these benefits as God’s gift to consumers, I can tell you the travel protection benefits will be very frustrating to use. Even if your claim does meet all of their requirements, I’ve read it can sometimes take people 8+ months to actually get reimbursed.

It’s possible these benefits will work out for you, but you will likely have to go through a lot of shit to actually get paid out. Some things may be easier like lost luggage insurance, others may be more difficult like trip interruption or trip cancellation insurance.

Who Is This Card For?

Do you want to dip your toes into the world of points with relatively low costs up front (a $95 annual fee)? Do you want an option that makes redeeming points very simple and consistent, but have the opportunity to explore more advanced techniques like transferring to partners? Do you fly a lot with United, JetBlue, or Southwest? Are you already in the points game with Amex, Citi, or Capital One but want to get some Chase Points so you can transfer to programs like Southwest, United, or Hyatt?

Even if the shit hits the fan and you decide “this card is not for me, I don’t want to use the points even for travel” you can redeem your points as a statement credit at a rate of 1.0 cents/point. Meaning the sign up bonus is worth a minimum of $800 if redeemed as a statement credit, $1,000 if used for travel on their portal, and more likely close to $1,500 if you utilize transfer partners.

The last thing I love about this card is that 12 months after you’ve signed up for it, if you decide you don’t want to pay the annual fee anymore anymore, you can downgrade (different than closing) the card to one of Chase’s no-annual fee cards, like the Freedom Flex or Freedom Unlimited. If you want more information on downgrading Chase cards, click here.

Who Should Not Get This Card?

Are you looking for things like big annual travel credits, lounge access, credits to reimburse the cost of TSA Pre-Check/Global Entry/Clear, or hotel status? This card might be a little too entry level for you. Do you realistically ONLY seeing yourself using the travel portal to redeem points? You may want to consider the Chase Sapphire Reserve. Yes, it costs $550, but a lot of that is offset with travel credits AND your points are worth a fixed 1.5 cents/point on the portal, instead of the 1.25 you get from the Sapphire Preferred (meaning you save an extra $25 per 10,000 points spent on the portal).

One last thing to consider is, are you currently using any of the airlines or hotel transfer partners? If you fly exclusively with Delta or American Airlines or even Spirit Airlines, and stay only at Hilton hotels, this card may not be the best for you. Yes, you can still book with all of those companies through the portal (and if that is your plan, disregard this), but you are potentially leaving money on the table by not being able to transfer your points to those programs.

How to Apply

First of all I want you to be sure you know everything that happens when you apply for a credit card. Do some quick Googling to learn about potential risks, how it affects your credit score, etc. Also IF YOU ARE APPLYING FOR A MORTAGE SOON (within about six months to a year), DO NOT OPEN ANY CREDIT CARDS.

If you do decide to apply for this card, there are a few routes to take. First, if you live near a Chase Bank, go in person to apply for a larger sign up bonus offer of 90,000 points. You will need to call and make an appointment with a banker who can help you apply. DO NOT use my referral if you live near a bank and are comfortable going in person and can meet the tiered spend requirements. I’d rather YOU get more points than ME getting a referral bonus.

If you don’t live near a Chase Bank, you can apply online for a still great offer of 80,000 points. If you do go this route, please use my referral link below. You still get the same offer, and I also get a referral bonus of 15,000 points. If you have a friend or a family member that has this card, ask them to refer you so they will get the 15,000 points.

**If for whatever reason you were not approved, send me a message as there are things you can do to help get approved after the fact. I cannot guarantee you are approved, even with some of the extra trips I may tell you**

No travel pictures this week, so enjoy a classic photo of my favorite being on this Earth, Ginny.

As always, feel free to leave a comment below of somewhere you’d like to go using credit card points. I’m also exploring the possibility of doing paid one-on-one consulting to help people plan a specific trip using points they have. Want to go from the West Coast to Europe but don’t know the best, cheapest, and most comfortable options? Let me help you out. Send me a message or an email if this is something you’re interested in.

kinda thought the ginny pics at the end of newsletters was my thing but the more the merrier

This was super informative! I've never had a credit card that charges a fee before but I'm starting to think it might be worthwhile. I don't think I could make the $4,000 in one month, though, so maybe I'll think about this in the future :)