Quick(ish) Points - New Limited Offers

New Chase Sapphire and Hyatt bonuses plus how to earn up to $650 without spending any money

Everyone’s favorite points starter card has a new offer I’ve never seen before, Hyatt is copying Marriott with a new sign-up bonus, and I discuss Rakuten (my favorite cash-back shopping portal) and a lucrative checking account bonus.

If you like this newsletter and want to further support this content, consider becoming a paid subscriber or using one of my referral links at the end of this newsletter.

Credit Card Bonuses

Chase Sapphire Preferred

I’ve written extensively about the CSP and why I think it’s probably the best “starter card” for dipping your toes into award travel. Chase is offering a new sign up bonus where “for a limited time,” you will earn 60,000 points + a $300 statement credit on travel booked through the Chase travel portal. You do need to spend $4,000 on the card within the first three months to earn the bonus.

To me, the 60,000 points can reasonably be redeemed for between $750 and $900 towards travel, so pairing that with the $300 travel credit you’re getting back between $900 and $1,200 in exchange for the $95 annual fee! Now, this isn’t the best offer* I’ve ever seen for this card, but it’s pretty damn competitive.

*The best offer was 100,000 points (worth roughly $1,500 towards travel) and a $0 annual fee for the first year, but that was during early Covid so I wouldn’t expect to see an offer that good again.

The $300 credit applies to any travel booked through the Chase Travel portal and you’ll get the amount spent (up to $300) refunded as a statement credit. It appears you don’t have to spend $300 all at once and you have one year from the day you open the card to use the full credit.

There are some small risks booking through third-party travel portals (like the Chase Travel portal, Expedia, Kayak, etc), but typically the risk revolves around needing to change your itinerary. If you have to alter your reservations, you must go through Chase Travel rather than the hotel/airline/rental car agency directly.

I find it’s best practice to confirm your third-party booking directly with the hotel/airline/rental car within 48 hours of booking to make sure everything looks good and is confirmed on their end. That way you don’t run into any unexpected issues on the day of travel and have to scramble to figure out a solution.

Would I get this offer? If I didn’t already have this card, yes I would. 60,000 points isn’t anything out of this world compared to previous bonuses, but it becomes a lot more appealing paired with that $300 travel credit. I know I’m going to spend at least $300 on travel in the next 12 months anyway, might as well put that $300 back in my pocket.

A quick note about using third-party travel portals

I personally don’t let the small risks of booking via third-party dissuade me from using the Chase Travel portal. At the same time, however, I always think how totally fucked my travel plans would become if I had to go through Chase customer service to save my vacation vs. being able to deal directly with the hotel/airline/rental car company.

A flight from SFO to anywhere in the US that has multiple flights per day? Virtually zero risk to me booking on Chase Travel. A flight from SFO to halfway across the world on a route that only flies three times per week? Yeah, I’m probably going to book that directly with the airline just to be safe and book my hotel through Chase instead.

Chase World of Hyatt

Even though the nicest hotel stay of my life was part of the Hilton portfolio, I still mostly prefer staying at Hyatt hotels when I travel. Hyatt’s award program offers the most bang for your buck, which I talk about in one of my previous trip reports to San Diego.

Typically, the standard World of Hyatt credit card offer is 60,000 points. This really hasn’t varied much over the years, but for a limited time they are trying something different: You will earn five (5) free night certificates after spending $4,000 in the first three months of opening the card. It seems they are taking a page out of Marriott’s book, who frequently offers 5 free nights as a bonus on some of their cards, too.

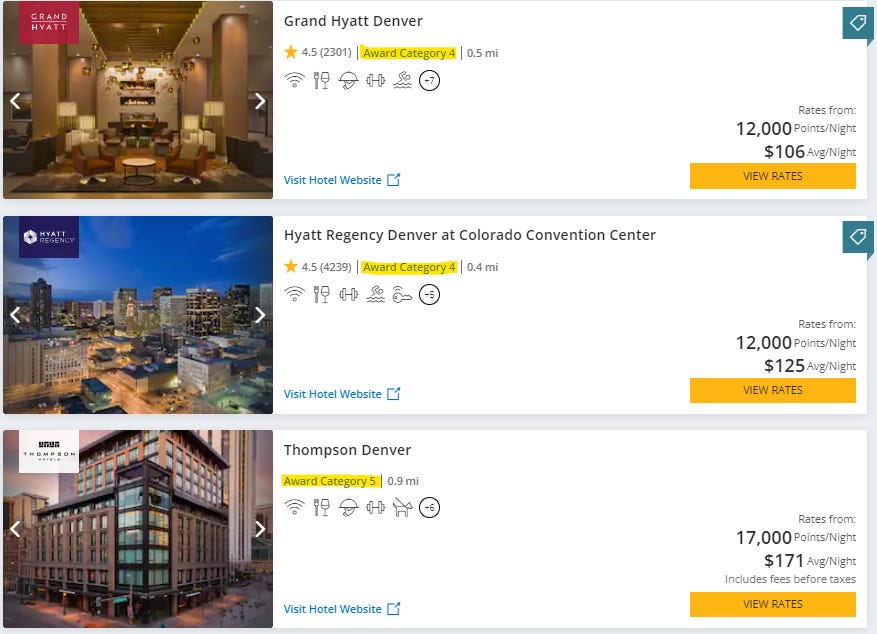

It’s important to note that Hyatt’s free night certificates (FNCs) differ from Hilton’s and Marriott’s. They can’t be used at any hotel in the portfolio (like Hilton’s) and can’t be topped off with extra points (like Marriott’s) to make them stretch farther. The FNCs earned from this Hyatt bonus are limited to hotels ranging from categories 1 to 4.

What does category 1 to 4 mean exactly? Well, Hyatt hotels are ranked on a category system ranging from 1 to 8, which generally reflect the average daily cash price for a room. The more expensive (and typically nicer) a hotel is, the higher the category. Whichever category the hotel falls under will determine the points price per room.

Part of why I love Hyatt is because they have a clearly defined range of what you will pay when using points across their entire portfolio.

The TLDR version of this is that you can redeem the FNCs from this bonus for hotels that would cost you between 3,500 and 18,000 points per night, depending on off-peak, standard, or peak pricing.

Let’s say you found a category 4 hotel that has has five nights available to book and each night costs 18,000 points. You can use your five FNCs instead of using the 90,000 points it would cost. This scenario provides you an extra 50% of value compared with the previous 60,000 point sign up bonus that has been the standard.

So, what’s the downside? Well, FNCs are only valid for for 12 months from the date they are issued. So if you don’t use it, you lose it, whereas points almost never expire. The other downside is that you’re limited to lower and mid-tier Hyatt hotels. Don’t get me wrong, there are still several incredible hotels where you can use these FNCs, but it excludes their upper-tier properties which may make this bonus a no-go for some people.

For someone who isn’t focused on staying at the absolute nicest and most luxurious hotel and has some travel in the next 12-15 months, this could be a very good card to open. Thankfully, Hyatt makes it easy to see every hotel across the globe within each category. This can give you some insight into what’s available before deciding if this bonus works for you.

While category 4 hotels won’t be the most luxurious, there is no shortage of hotels in this range that would provide an outstanding quality-to-cost ratio, including: Hyatt Centric Fisherman’s Warf, Andaz Mexico City, Grand Hyatt & Hyatt Centric Denver, Thompson Washington D.C., Hyatt Regency Austin (TX), Andaz Savannah (GA), Hyatt Centric Chicago Mag Mile, Grand Hyatt Berlin, Hyatt Regency Pairs Etoile, and Hyatt Regency Tokyo (to name a few).

Would I get this offer? If I was planning to travel in the next year and found a Hyatt that could work for my preferences, yes most definitely considering it could save me likely $1,000 or more. If I was planning to stay at category 1 and 2 hotels that would generally only cost me 5,000 or 8,000 points per night, or I wanted to use my points on a nicer hotel for only 1 or 2 nights, then I would skip this offer and wait for the standard 60,000 point bonus to return, or just get the Chase Sapphire Preferred.

Checking Account Bonus

What Are Checking Bonuses?

Checking account bonuses are something I have yet to discuss, but the super condensed version is that banks and credit unions will frequently offer a one-time bonus for opening a new checking account and meeting some other requirement. More often than not, that requirement involves having a certain amount of money direct deposited (like from an employer, not from a different bank account in your name) to your account in a specific time frame.

A few years ago, my employer allowed me to change my direct deposit information online without needing to contact HR. I went HARD on these checking account bonuses, earning just over $1,800 in 2022 because it legitimately took me less than 5 minutes between the time it took to set up a new checking account and change my direct deposit info with my employer.

The money you earn is taxable and reported as interest income by your bank*, but otherwise is relatively risk free since almost all checking accounts are free to open and don’t show up on your personal credit report / affect your credit score. There are extremely rare cases where a hard-pull on your credit file can occur, but this has never happened to me.

*I am not a tax specialist! Always consult a tax specialist!

Doctor of Credit is the leading aggregate website for all things credit cards / bank account bonuses and they have a great beginners guide to bank bonuses that has more info and great FAQs.

SoFi

Right now SoFi bank has a new account bonus of up to $300 after initiating direct deposits totaling $5,000 or more. You must be a new SoFi customer and open either a checking or savings account (or maybe it was both? always check the fine print). The direct deposit requirement, which can be completed with more than one DD, has to be completed no more than 25 days after your first deposit hits your account.

This is a tiered bonus, so you if you can’t hit the $5,000 requirement in a 25 day span, you can still earn a $50 bonus for direct deposits totaling at least $1,000, which isn’t that great if you ask me. $300 for a new checking account bonus is a solid deal though, but where this gets even better is if you first go through Rakuten.

Rakuten

Rakuten is a shopping portal that lets you earn cash back from from online (and sometimes in-store) shopping. It’s the closest thing I’ve experienced to getting “free money.” If you’ve ever watched a Golden State Warriors basketball game, you may have noticed a Rakuten advertisement patch on their jerseys.

By going through Rakuten’s portal, or adding their browser extension, you can see which retailers are offering “cash back” on purchases. Simply click the retailer you want to shop with and Rakuten will redirect you their website. If you then make a purchase, Rakuten will give you a certain percentage of your subtotal as cash back into your Rakuten account.

Above is a picture on the home page on Rakuten at the time of this writing where they have up to 20% cash back with specific retailers. The “cash back” in your account is paid out four times per year via physical check or directly to your PayPal. Typically the cash back offered ranges from 1% to 10% depending on the store, but they frequently have these limited-time deals offering 15% or more.

When I first saw T.V. commercials for Rakuten back in like 2015 I thought it was some weird scam with these awful actors going “I made $700 cash back just from SHOPPING ONLINE!” And while most people won’t earn $700 in cash back (at least not for a long time), Rakuten is far from a scam.

In fact, my “lifetime cash back” dating to about 2016 is nearly $1,300. You just have to be okay with delayed gratification since the “cash back” is a rebate that happens several months after your purchase.

It’s free to join and if you use my referral link, you’ll automatically get $30 cash back when you spend at least $30 on a purchase within 90 days, on top of whatever cash back is included with your purchase.

But if this isn’t a scam, how do they make money? From my understanding, they make their money two ways: affiliate marketing and selling your data (but what else is new). Companies listed on Rakuten will pay a commission if you buy something from them, which is why Nike and Adidas will sometimes advertise 15% cash back through Rakuten. If I’m going to look for a new pair of shoes, and I see Nordstrom is offering 2% cash back, but Adidas is offering 15% cash back, I’m probably going to buy my Ultraboosts from Adidas directly even though I like Nordstrom more as a company.

Now The Good Stuff: Combining Rakuten and SoFi

Until December 31st, 2024, Rakuten is offering $350 $125 cash back if you open a new SoFi checking/savings account and have your very first direct deposit total $500 or more within 45 days of opening.

This is a totally separate offer from SoFi’s $50/$300 checking account bonus, so you can “stack” these offers and make between $400 and $650 $175 and $425 if you meet both, separate requirements by going through Rakuten first.

EDIT: It appears that Rakuten has reduced the offer from $350 back down to $125. They do this periodically, check back in a few days to see if the offer has returned to $350.

Doctor of Credit has a good write-up about this “stack” and gives an overview of all the fine print, although I’d still recommend reading Rakuten’s and SoFi’s fine print, respectively. It’s good to know there isn’t a monthly fee associated with a SoFi account, but it’s unclear if there is any early termination fee*

*some banks will mandate that you keep your new checking account open for “X” number of days (usually 180) before you can close the account, otherwise they will take back the bonus.

Would I do this? Yes, 100% but sadly I can’t. I already got a $300 SoFi checking bonus in 2022 and I’m no longer considered a “new customer” making me ineligible. If I was still eligible, even though I now have to go through my HR department to change my direct deposit, I would still do this in a heartbeat for $650 $425.

While I don’t use SoFi as my main bank, I didn’t have any issues with them when I was using them for DD. They also offer a fairly competitive APY (4.5% at the time of writing) on their savings accounts if you continue to receive direct deposits every month.

If you do want to pursue this deal and stack with the Rakuten offer I’d recommend doing it on a computer. Just make sure once you click on the link through Rakuten, you don’t exit the page and can finish signing up in one sitting, otherwise Rakuten might not “track” the activity and give you credit. That goes for all purchases through Rakuten though, not just this specific deal.

I’ve had issues with tracking on purchases I’ve made and every time I’ve reached out to Rakuten support it’s been credited, but it might be more difficult on something like a checking account bonus where it could be two+ weeks before you meet the requirements. Regardless of if you plan to pursue this checking account bonus, I can’t recommend Rakuten enough to earn money on purchases you were likely going to make in the first place.

Planning to open the Chase Sapphire Preferred or create a Rakuten account? Don’t forget to use my referral link to help support this content (just make sure the card you’re applying for is the right one! i.e. Sapphire Preferred vs. Sapphire Reserve).

Do you have any questions about any of these sign-up bonuses? Feel free to leave a comment below or you can also email me directly!

Disclaimer: This post contains personal referral links to credit cards.